NAEPC Webinars (See All):

Issue 44 – July, 2024

Life Settlements – The Hidden Tool to Unlock, Preserve and Rescue Value in the Estate Plan

By Tama Brooks Klosek, JD*, and Michelle Graham**

I. SYNOPSIS

In developing an estate plan for clients, life insurance can often play a key role. However, many clients do not understand the complexity of the product being purchased or realize the risks in the contract and potential for the life insurance to lapse prior to life expectancy. In addition, it is possible for a life insurance contract as it matures to reach a “crossover point” when continued investment in the contract may not yield an optimal financial result.[1] This article seeks to help estate planning and probate attorneys, including fiduciary litigators, as well as financial, wealth, insurance and other tax advisors to understand the life settlement strategy for exiting a life insurance contract if the insurance policy cannot, should not or will not be maintained, and the potential liability for fiduciaries of life insurance trusts who fail to become informed regarding the life settlement market and share such information with trust grantors and beneficiaries. An estimated 500,000 insurance policies that may qualify for a life settlement lapse or are surrendered annually;[2] however, in 2023, only 3,213 policies were sold in a life settlement transaction, slightly up from 3,057 in 2022.[3] This shocking differential can be explained by one problem—the lack of knowledge among insureds and their advisors regarding the life settlement market.

The following is a case study of a 75-year-old West Coast winemaker who established an irrevocable life insurance trust to purchase an aggressively illustrated premium financed indexed universal life insurance contract. In connection with the premium financing, the policyowner trust provided a note to the lender for $2.4 million that was secured by the policy and guaranteed by the winemaker’s vineyard. The note was scheduled to mature within 30 days and the cash surrender value in the contract was $1.3 million, meaning the winemaker, as guarantor, was going to have to pay about $1.1 million out of pocket to the lender or risk foreclosure and loss of the vineyard. At that time, the winemaker could not afford the additional $1.1 million required to repay the amount due under the note. Fortunately, the winemaker’s attorney was introduced to a qualified life settlement broker who was engaged by the trustee to sell the insurance contract with a goal of realizing an amount greater than the $1.3 million cash surrender value and minimizing the winemaker’s out of pocket expense on unwinding the contract. What happened next was amazing but not atypical for the current life settlement market—the policyowner trust not only was able to repay the outstanding note in its entirety but also made a significant profit on the sale. The final gross offer received and paid on the contract was $4,051,000. The foregoing is consistent with studies finding that, on average, a life settlement may yield four times the amount of the cash surrender value under the contract.[4]

Arising from a somewhat sordid history that involved fraud during the viatical settlement industry’s early days when it rose to popularity in the 1980s, the life settlement industry has evolved substantially and is heavily regulated. For example, under the terms of Texas Insurance Code sections 1111A.003 through 1111A.013 and California Insurance Code sections 10113.1 through 10113.3, life settlement brokers and providers are required to obtain a license to transact life settlement business in Texas or California and are subject to both licensing and consumer disclosure requirements.[5] Texas and California are not alone in adopting life settlement regulations, and, today, the insurance laws of 43 states regulate the sale of life insurance to protect the interests of the parties to a life settlement transaction.[6]

The ability to sell life insurance in a purchase and sale transaction is not a new idea, and the authority for a policyowner to sell life insurance was initially confirmed by the United States Supreme Court in Grigsby v. Russell over a century ago. Although life settlements are the most consumer-centric development to happen in the life insurance market, some insurance companies, seeking to preserve the large profits generated by surrenders and lapses, go so far as to prohibit their agents from even discussing settlements with policyowners. A California class action lawsuit that settled in 2015 included claims of breach of fiduciary duty when a broker purposefully did not educate the policyowners about life settlements as an option for policy termination, knowing that the insurance company profits more when policies are surrendered instead of sold. In that case, the federal district court in California recognized the duty of life insurance agents and companies to provide information regarding the life settlement option to policyowners in advance of surrendering their insurance policies for the cash surrender value.[7] Accordingly, California insurance companies and insurance agents may have a greater duty than similarly-situated parties in other states to provide information regarding the life settlement option and may face liability for failing to do so if a policy is surrendered or lapses. At this time, only seven states, including Kentucky, Maine, New Hampshire, Oregon, Rhode Island, Washington and Wisconsin, adopted formal regulations requiring that life insurance companies inform the policyowners of alternative options, such as life settlements, when considering a lapse or surrender.[8] California and Florida both require that insurance companies provide a “limited disclosure” to individual policyowners regarding alternatives to a surrender or lapse by providing them with a statement advising that if the policyowners areconsidering making changes to their policy, they should consult with a licensed insurance or financial advisor.[9] Considering the limited requirements for disclosure of the life settlement option under the current laws in many states, the lack of agent and carrier transparency, particularly for carriers that actively prohibit their agents from participating in life settlement transactions, remains a problem for most policyowners nationwide. The carriers, on the other hand, profit greatly from lapses and surrenders.

II. Irrevocable Life Insurance Trusts

Although life insurance generally is exempt from income tax within the contract and when the death benefit is paid, life insurance is subject to federal estate tax at the death of the insured if the insured retained any “incidents of ownership” with respect to the contract at the death of the insured (or, for policies transferred from the insured, within three years of the insured’s death).[10] Considering the foregoing, many wealthy clients are counseled to acquire new life insurance in, or transfer existing life insurance to, a properly structured irrevocable life insurance trust to protect the death benefit from federal estate tax at the death of the insured or the surviving spouse of the insured. Depending on when the insured dies, trust-owned insurance can provide significant leverage of the gift, estate and GST tax exemptions. [11]

III. Investment in Life Insurance as a Hedge Against an Early Death

Estate planning professionals who recommend life insurance for wealthy clients who otherwise have sufficient assets to replace income lost by the death of an earning spouse, or to pay income and death taxes resulting from death, often suggest insurance to provide a hedge in the estate plan against an early death before the other transfer tax techniques being developed by such professionals have had the opportunity to mature. In addition, with the increase in the use of spousal lifetime access trusts (“SLATs”) because of the increase in the value of the lifetime gift, estate and GST exemptions over recent years to an unprecedented $13.61 million in 2024, life insurance may provide a source of liquidity to the spouse who is not the SLAT beneficiary if the beneficiary-spouse dies early.[12] When an insured dies early, the investment in life insurance is an extremely profitable investment.

IV. Wealthy Individuals Live Longer

Although none of us knows when death may occur, wealthy persons live significantly longer than less wealthy persons. The average life expectancies for men and women under the Updated Static Mortality Tables for Defined Benefit Pension Plans for 2023, IRS Notice 2022-22, are 80 for men and between 82 and 83 for women. However, in a study of the top 1% of income earners in the United States, the highest earning men and women were expected to live 15 years longer for men and 10 years longer for women, with average life expectancies of 87.3 years and 88.9 years, respectively. The lowest income earning persons having life expectancies of ages 72.7 years for men and 78.8 years for women.[13]

Considering that the wealthiest portion of our population can be expected to live the longest, life insurance as a hedge against an early death is less likely to pay off early and result in large returns to the investment in the life insurance contract. In fact, most term and permanent life insurance policies actually terminate or lapse before they pay a death benefit, and the statistic often cited is that 88% of all universal life insurance contracts are either surrendered or lapse before ever paying a death benefit.[14]

V. Types of Life Insurance Commonly Used in Estate Planning

The most common types of life insurance policies used in connection with estate planning include term insurance and permanent insurance. Most estate plans for younger clients rely on level term insurance coverage because this is the most cost-effective coverage to insure the risk of an untimely death before wealth has had the opportunity to grow. Level term insurance provides a guaranteed death benefit over a term of years for the payment of an established premium and often has conversion rights which allow the policyowner to convert the coverage to permanent insurance without additional medical underwriting.

Permanent insurance is referred to as such, but that name can actually be a misnomer. Permanent insurance, such as whole life and universal life insurance, is only “permanent” if the policy is properly funded and maintained throughout the life of the insured. Permanent insurance carries with it an income-tax free investment component known as the cash value account. The cash value account receives premium contributions in the earlier years of the policy that are greater than the mortality charges and other costs of insurance. The excess amounts contributed to the cash value account appreciate over the term of the contract income tax free and, if properly funded over the life of the policy, should result in maintaining the contract through the life of the insured. The cash surrender value account is the amount that will be paid to the policyowner if the contract is surrendered.

A universal life insurance policy may be intentionally underfunded in the early years of the contract to minimize the cost of the insurance coverage while providing the option to increase premiums in later years if the coverage is advisable to maintain. Even if the contracts perform similar to the illustrations, these “catch-up” premiums can be significant.

Because life insurance illustrations are static projections based on current circumstances and certain assumptions, policies may not perform as originally illustrated. Considering this potential disparity along with the changes that naturally occur over time within families with respect to their assets and objectives, life insurance is not a “set it and forget it” estate planning strategy but requires ongoing oversight and management.

VI. Strategies for Exiting a Life Insurance Contract That Will Not Be Maintained

Most estate planning attorneys realize that “permanent” insurance policies lapse without paying a death benefit or are surrendered for a fraction of the premiums paid in, and they do so on a very regular basis. All of the thoughtful planning may have been completed without any significant wealth transfer benefit for the client. This is not the fault or responsibility of the estate planning attorney but a function of changed circumstances—for example, (i) a significant liquidity event for the client, combined with meaningful wealth transfer, may mean the insurance policy is no longer desired; (ii) a decline in wealth where it is no longer practical or beneficial for the client or other policyowner to maintain the insurance; (iii) owning a universal life insurance policy that has underperformed or was intentionally underfunded and is now at that crossover point where continued investment in the contract may not yield the optimal financial result, including a premium financed contract especially in a rising interest rate environment; and/or (iv) a plan to use the value of an existing insurance contract to purchase other assets to increase the wealth of the family. In addition, premium fatigue and confusion are also very real in the insurance world—wealthy individuals become exhausted by the continued required funding of an insurance contract and confused about the original purposes of the insurance acquired years prior, and sometimes they decide to cease paying into a contract. But what if the client, like the winemaker in the case study above, was advised that an insurance policy that was going to lapse or be surrendered could be sold to a sophisticated institutional investor within a short period of time, 60 days or less, thereby transforming the policy from an asset (or liability depending on the viewpoint) with no current value or continued purpose within the plan, or with a value that was a fraction of the amount invested in the contract, to an asset with a value that may be well in excess of the premiums paid and multiples of the cash surrender value? We can tell you from experience what would happen—the client would be incredibly grateful for your sage counsel and the ultimate receipt in the life settlement transaction of significant value that would have otherwise been lost.

VII. Selling Insurance in a Life Settlement

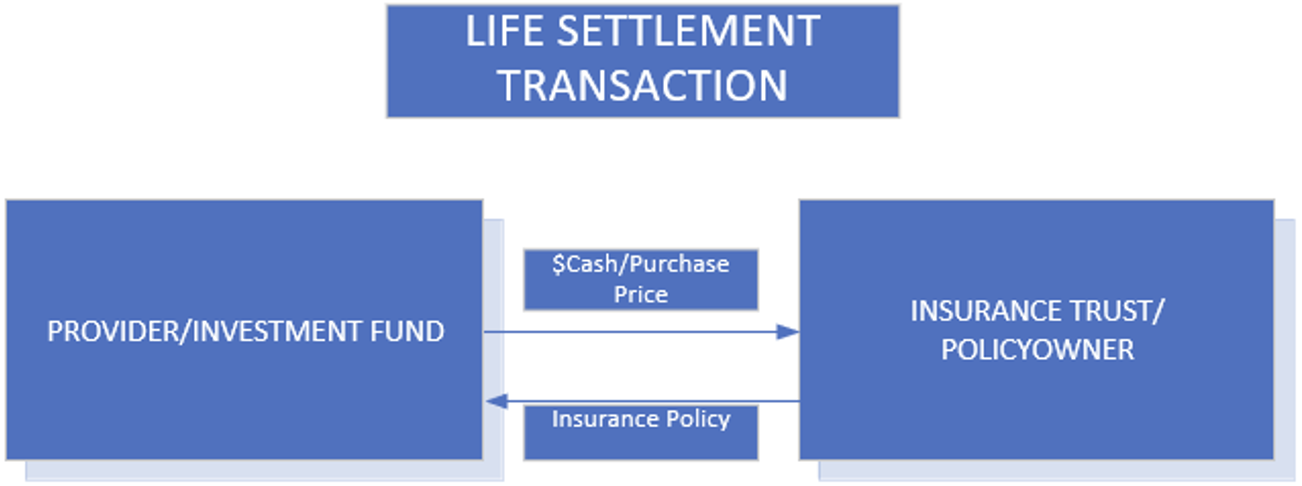

Although business models vary, in a typical life settlement scenario, a policyowner (whether an individual, trust or entity owner) sells an existing policy to a life settlement provider that facilitates a simultaneous transfer of that policy to the purchaser. This process is somewhat analogous to a title company in a real estate transaction, but, in this case, the provider only represents the interests of a private investment fund or other investor purchasing the policy. That fund or other investor, in turn, receives the policy from the provider and holds the policy until maturity, pays the premiums, and collects the net death benefit. The fund or other investor may also sell the policy to another investor prior to the death of the insured, similar to the way residential mortgages are pooled, packaged and sold in the institutional market. The following visual illustrates a typical life settlement transaction:

Considering the significant expertise required to properly understand, market, and consummate sales of existing insurance contracts to life settlement providers, policyholders are well advised to initiate these transactions by contacting an experienced and qualified life settlement broker or by having their estate planning attorney, tax advisor and/or financial advisor help them retain such a broker.

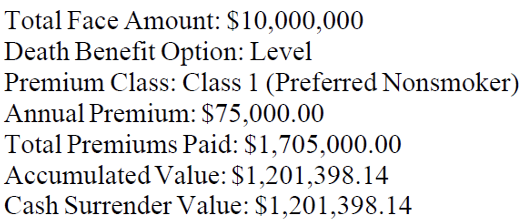

Policy Summary:

Auction Summary:

VIII. Policies That Qualify for a Life Settlement

Individual and second-to-die universal life, indexed universal life, variable universal life, and convertible term life insurance policies typically qualify for life settlements, and approximately 95% of all policies sold in a life settlement transaction are universal life insurance policies. The age and the health of the insured will dictate whether there is an interested purchaser, and the insureds in a life settlement transaction typically have a life expectancy of 15 years or less. The age of the insureds in a life settlement transaction is usually over age 70, or younger than age 70 with some type of health impairment, or there is a larger death benefit contract.

IX. Tax Treatment of Traditional Life Settlements

The tax treatment of life insurance during the contract and upon payment of the death benefit is very favorable to policyholders and their beneficiaries. For permanent insurance designed to build up cash and/or investment value, investment savings grow without income tax consequence, and the death benefit is similarly not subject to income tax.[15]

Although there has been some confusion regarding whether life insurance is ordinary income or capital gain property, a life insurance policy should be considered a capital asset when sold in a life settlement transaction.[16] In Revenue Ruling 2009-13 the Service examines the sale of a life insurance policy in a life settlement style transaction. In that ruling, the Service determined that the inside build-up of cash value in excess of basis immediately prior to the sale was ordinary income, but the balance of the purchase price received would be long-term capital gain.[17] I.R.C. § 1016(a) and Revenue Ruling 2020-5 confirm that the seller’s cost basis in a life insurance policy is not reduced by the cost of insurance and the cost basis equals the premiums paid less the amounts received under the contract. Since the cash surrender value is often not in excess of the premiums paid under a universal life contract, the entire gain in a life settlement transaction is usually taxable as long-term capital gain.

The sale of an insurance policy on the life of an insured who is terminally ill to a viatical settlement provider will not be taxable, and the entire amount received will be excluded from income to the seller because such amounts qualify as amounts paid by reason of the death of the insured.[18] An insured who is “terminally ill” or “viatical” can reasonably be expected to die within 24 months.

The exclusion from income for life settlement proceeds for chronically ill individuals is different than for viatical individuals and is limited to the amounts received for qualified long-term care services for the insured person that are not compensated for by insurance or otherwise if the terms of the contract giving rise to such payment meet the requirements of I.R.C. § 7702B(b)(1)(B). A “chronically ill” individual is an individual who has been certified by a licensed healthcare practitioner as: (1) being unable to perform, without substantial assistance from another individual, at least two activities of daily living for a period of at least 90 days because of a loss of functional capacity; (2) having a similar level of disability, as defined in the regulations; or (3) requiring substantial supervision to protect him or her from threats to health and safety because of severe cognitive impairment.[19] It is important that advisors understand these qualifications and the tax treatment prior to beginning the life insurance settlement process.

X. Trust Owned Life Insurance (“TOLI”)

Trustees have fiduciary duties to their beneficiaries that include (i) the duty to administer the trust in good faith according to its terms and the governing law;[20] (ii) the duty to invest and manage trust assets in accordance with a standard of care;[21] (iii) the duty of loyalty;[22] and (iv) the duty to provide information to beneficiaries and make a full disclosure of material facts,[23] among others. As discussed above, life insurance is not a buy and hold or a “set it and forget it” investment strategy but is an asset that requires ongoing management. Fiduciaries of insurance trusts have a duty to monitor and manage the policies held in trust, and in connection with the exercise of this duty, should obtain regular policy statements and illustrations. These fiduciaries should also coordinate annual performance reviews or audits with the assistance of an insurance professional or policy audit provider to determine (i) whether the policy is performing in a manner consistent with the illustrations; (ii) the insured’s age when the policy is projected to lapse; and (iii) whether the policy”s performance and purposes align with the grantor’s intentions (and the beneficiaries’ circumstances and needs, as the case may be). If current policy projections and funding levels will not maintain the policy, trustees should seek professional advice regarding options for preserving the value in the insurance contract, including life settlements.

For trustees of insurance trusts where the grantor (often the insured) indicates an unwillingness to continue to make contributions to support premium payments, fiduciary liability may not be avoided by relying on exculpatory clauses in the trust agreement that the trustee has no responsibility to pay premiums or arrange for gifts to the trust from the grantor to enable premiums to be paid.[24] The trustees may wish to consider sending a notice of proposed action to the beneficiaries to give them an opportunity to object before the trustee takes, or does not take, a particular action. In California, and other states, such notice allows trustees to obtain immunity from breach of trust claims without waiting for the statute of limitations to run and without the need to obtain an order from the court having jurisdiction.[25] For example, trustees may send a notice of proposed action to the beneficiaries of a life insurance trust that the trustee will no longer be making premium payments and that the trustee intends to surrender or sell the policy, or let the policy lapse, unless a beneficiary objects.

XI. Accessing the Life Settlement Market

The authors cannot underscore enough the importance of working with an experienced and qualified life settlement broker that markets policies in a fashion designed to access and engage qualified providers licensed to purchase policies in the policyowner’s state of residence.

Commissions on life settlement transactions can be significant and there is a range of commissions charged. Fees should be considered and compared among the brokers being considered and should always be fully disclosed in advance of retaining a life settlement broker. Note, some states do not require a full disclosure of the life settlement broker commissions that are paid by the seller at closing from the purchaser’s gross sales price—accordingly, be wary of the broker that is not completely transparent regarding commissions and how they are calculated and paid.[26]

In connection with selecting a broker, the client should confirm if the broker has any relationships or agreements with any life settlement providers and confirm whether such relationships or agreements could adversely impact the auction process. In addition, the life insurance advisor’s role in the life settlement transaction is not required but should be clearly defined prior to engaging a life settlement broker and then communicated to both the life insurance advisor and the life settlement broker.

In a life settlement transaction, it is important to understand that the life settlement broker is the only party in a life settlement transaction who is a fiduciary to the seller and the only party in a life settlement transaction required by law to act according to the seller’s instructions and in the best interests of the seller. Although life settlement providers may advertise widely on television, radio and the internet and offer to “help” policyowners sell their life insurance, life settlement providers only represent the purchaser in a life settlement transaction and do not represent the seller. While the provider may or may not be affiliated with the purchaser, neither the provider nor the purchaser is required to inform or educate the seller regarding the true worth of their policy or offer a fair market value price for their policy in a life settlement transaction. The only party that represents and has a fiduciary duty to the seller in a life settlement transaction is a life settlement broker. Since it may be difficult for the seller to discern the actual interests of the provider in a life settlement transaction when the provider purports to be assisting the seller, it is imperative for the seller to clarify the role that each participant in the transaction has in a life settlement at the outset of the transaction.

In response to concerns regarding the life settlement market, including some of the concerns raised in the preceding paragraph regarding provider practices, on July 31, 2023, the Financial Industry Regulatory Authority (“FINRA”), published a brief and straightforward report entitled “What You Should Know About Life Settlements” which reviews factors for a policyowner to consider when deciding whether to sell a life insurance policy in a life settlement transaction.[27] The 2023 FINRA report specifically highlights the difficulty in determining fair pricing in a life settlement transaction and advocates “using a licensed life settlement broker who will shop your policy” to address the foregoing concern. FINRA expresses additional concern regarding the competitiveness of pricing offered by life settlement providers directly to policyowners and warns sellers about “high-pressure sales tactics or other aggressive marketing and sales efforts.”

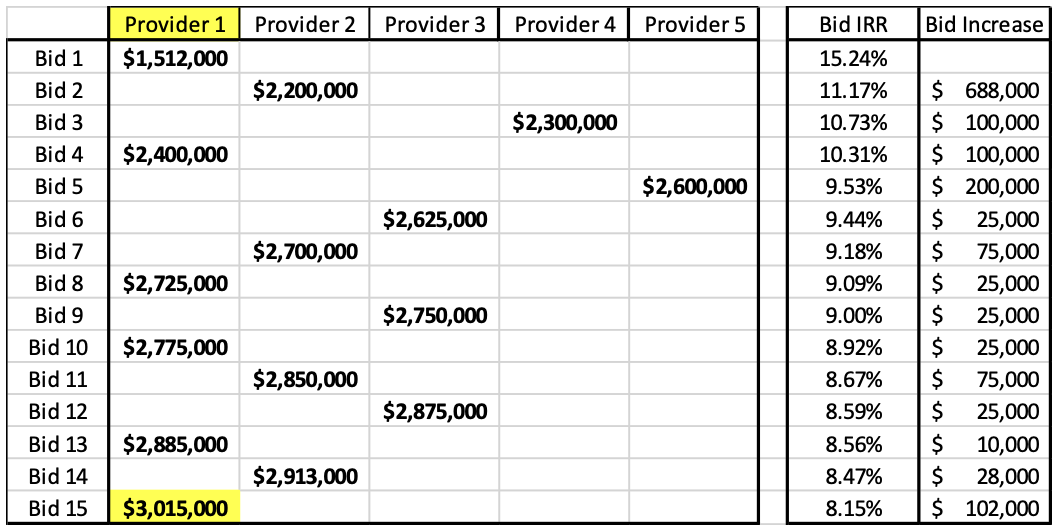

The following chart summarizes the life settlement process:

Although there are criticisms that life settlement transactions can take a long time, if properly conducted with the assistance of experienced advisors, transactions can proceed efficiently and close within 60 days.

XII. Concluding Thoughts

Life insurance can solve a myriad of complex estate planning issues in a seemingly straightforward manner and for an understood cost. However, the ongoing management of life insurance, particularly with a life insurance settlement, is not straightforward or well-understood.

Policyowners and their advisors remain largely unaware of the opportunity to sell a life insurance contract with more favorable results than in a situation where the policy is surrendered or the policy lapses. You may now decide to include information about life settlements in future client memoranda regarding life insurance trusts, and, if you are an attorney, you may consider specifically authorizing trustees to sell insurance policies in a life settlement transaction in the insurance powers section of your life insurance trust agreements.

Not every life insurance policy is a candidate for a life settlement, but if there is a determination made that continuing to maintain an insurance policy is no longer advisable, or if the policy is otherwise not desired, a life settlement should be considered as an option. In addition, to avoid fiduciary liability, it is the responsibility of trustees of life insurance trusts to become informed regarding life settlements. Lastly, by becoming more informed regarding a client’s life insurance policies as the contracts mature, not just at the front-end when the coverage is placed and the insurance trust is established, estate planning attorneys and other advisors can help clients avoid lapses and policy surrenders and, thereby, rescue value that would otherwise be lost.

*TAMA BROOKS KLOSEK

Klosek & Associates PLLC

Treyled Life Settlements LLC

1885 St. James Place, Suite 1265

Houston, Texas 77056

Ph: 713.255.0495

tklosek@kloseklaw.com

tklosek@treyledls.com

**MICHELLE GRAHAM

Withers Worldwide

12830 El Camino Real, Suite 350

San Diego, California 92130

Ph: 858.400.1307

michelle.graham@withersworldwide.com

[1] See Pauloski, Thomas J. and Andrew T. Bishop, Triangulation: Integrating Life Insurance into the Estate and Investment Plans, Bernstein Private Wealth Management, 2019, at 1 and 12.

[2] Magna Life Settlements, Life Settlement Industry Report at 30 (2018) (citing research from the Insurance Studies Institute).

[3] Id.; Horowitz, Donna, “Life Settlements Up Last Year, Market Makes Partial Recovery,” The Deal (June 15, 2023) at 2; 2023 LISA Member’s Annual Market Data Collection Report https://www.lisa.org//Files/LISA_2023TransactionData_FinalWeb.png (last visited May 10, 2024).

[4] Afonso V. Januário & Narayan Y. Naik, Empirical Investigation of Life Settlements: The Secondary Market for Life Insurance Policies, London Business School, June 10, 2013; see also 2022 LISA Member’s Annual Market Data Collection Report (finding that during 2023 a life settlement yielded on average 6.2 times the cash surrender value offered by the carrier).

[5] See Tex. Ins. Code §§ 1111A.003 – 1111A.013 and CA Ins. Code §§ 10113.1-10113.3.

[6] Life Settlement Regulation – Map of Regulatory Law, Life Insurance Settlement Association, https://www.lisa.org/map_of_regulatory_law (last visited Nov. 26, 2023).

[7] See Grill et. al. v. Lincoln National Life Insurance Co., 2014 WL 12588653 (C.D. CA (2014)).

[8] The Importance of Disclosures, Life Insurance Settlement Association, https://www.lisa.org/article_content.asp?article=35 (last visited Nov. 26, 2023); RI Gen L § 27-4.10-2 (2022)

[9] Ca. Ins. Code § 10113.2(j); Fla. Stat. § 626.99292).

[10] I.R.C. §§ 101(a)(1), 2042, 2035; see Treas. Reg. § 20.2042-1(c)(2).

[11] Adam Abrahams, Irrevocable Life Insurance Trusts as an Effective Estate Tax Reduction Technique, ABA Section of Taxation News Quarterly (Summer 2013); https://www.americanbar.org/content/dam/aba/publishing/aba_tax_times/14win/7-abrahams.pdf (last visited May 2, 2024).

[12] Rev. Proc. 2023-34.

[13] The Equality of Opportunity Project, http://www.equality-of-opportunity.org/health/ (last visited Nov. 26, 2023).

[14] See Daniel Gottlieb & Kent Smetters, Lapse-Based Insurance, Olin Business School, Washington University and Wharton School, University of Pennsylvania 5 (June 6, 2016), https://faculty.wharton.upenn.edu/wp-content/uploads/2016/11/Insurance41.pdf (last visited Nov. 26, 2023).

[15] I.R.C. §§ 7702(g), 101(a)(1).

[16] I.R.C. § 1221.

[17] Rev. Rul. 2009-13.

[18] I.R.C. § 101(g).

[19] I.R.C. §§ 101(g)(4)(B) and 7702B(c) (defining a chronically ill individual and providing that activities of daily living are: eating, toileting, transferring, bathing, dressing, and continence).

[20] Tex. Prop. Code § 113.006, 113.05; Cal. Prob.Code §16000.

[21] Tex. Prop. Code §§ 117.003–117.006; Cal. Prob. Code §16006.

[22] Tex. Prop. Code § 117.007; Cal. Prob. Code §16002.

[23] Tex. Prop. Code § 113.151; see also Huie v. DeShazo, 922 S.W.2d 920 (Tex. 1996) (stating that trustees have a fiduciary duty of full disclosure of material facts that might affect beneficiaries’ rights); Cal. Prob. Code §16060 et seq.

[24] Even if the trust says that a particular action is entirely within the trustee’s discretion, the trustee has a duty to act reasonably in exercising that discretion. See Sassen v. Tanglegrove Townhouse Condo Assoc., 877 S.W.2d 489 (Tex. App.–Texarkana 1994, writ denied); see also (Tex. Prop. Code §§ 113.006 and 117.003 – 117.006).; see, e.g., Rafert v. Meyer, 209 Neb. 219 (Feb. 27, 2015) (finding that the trustee had a statutory duty under Nebraska law “to keep the qualified beneficiaries of the trust reasonably informed … of the material facts necessary for them to protect their interests,” and the failure to receive premium notices and provide information to the beneficiaries regarding the required premiums was a direct and proximate cause of the damages. The trustee was found to have liability even though the trust agreement provided that the trustee had no obligation to pay premiums or make sure they were paid by the grantor.)

[25] See, e.g., Cal. Prob. Code §§ 16500-16504.

[26] Texas, California, and Florida require disclosure of life settlement brokerage fees. Tex. Ins. Code § 1111A.012(a)(8); Ca. Ins. Code § 10113.2(e); Fla. Stat. § 626.99181)

[27] FINRA, “What You Should Know About Life Settlements” (July 31, 2023) https://www.finra.org/investors/insights/what-you-should-know-about-life-settlements (last visited Nov. 26, 2023).